As published by Al Jazeera America April 12, 2015.

QUEBEC CITY — Twenty-five years ago, Quebec made a bold move to produce the most maple syrup in the world. Today, the syrup giant is unstoppable.

Just ask those in its path, like small producer Angèle Grenier, who will face criminal charges if she sells this year’s harvest to her buyer of choice.

In previous years she has sold syrup to a broker in New Brunswick. But this year, a Quebec court order will force her to hand all the syrup produced on her small patch of land to the Federation of Quebec Maple Syrup Producers.

The family has three choices for the upcoming harvest — capitulate to the demands of the court, cease production, or continue to sell it outside the province and face criminal charges.

“The federation’s goal by taking our maple syrup is that by taking our income, we cannot pay our lawyers,” says Grenier. “We’ll send our syrup to them this year because we need the money.”

Welcome to Big Syrup.

Simone Vezina serves up food for guests visiting her sugar shack in Saint-Modeste, Quebec. She has run it for the last 10 years. Leyland Cecco/Al Jazeera America

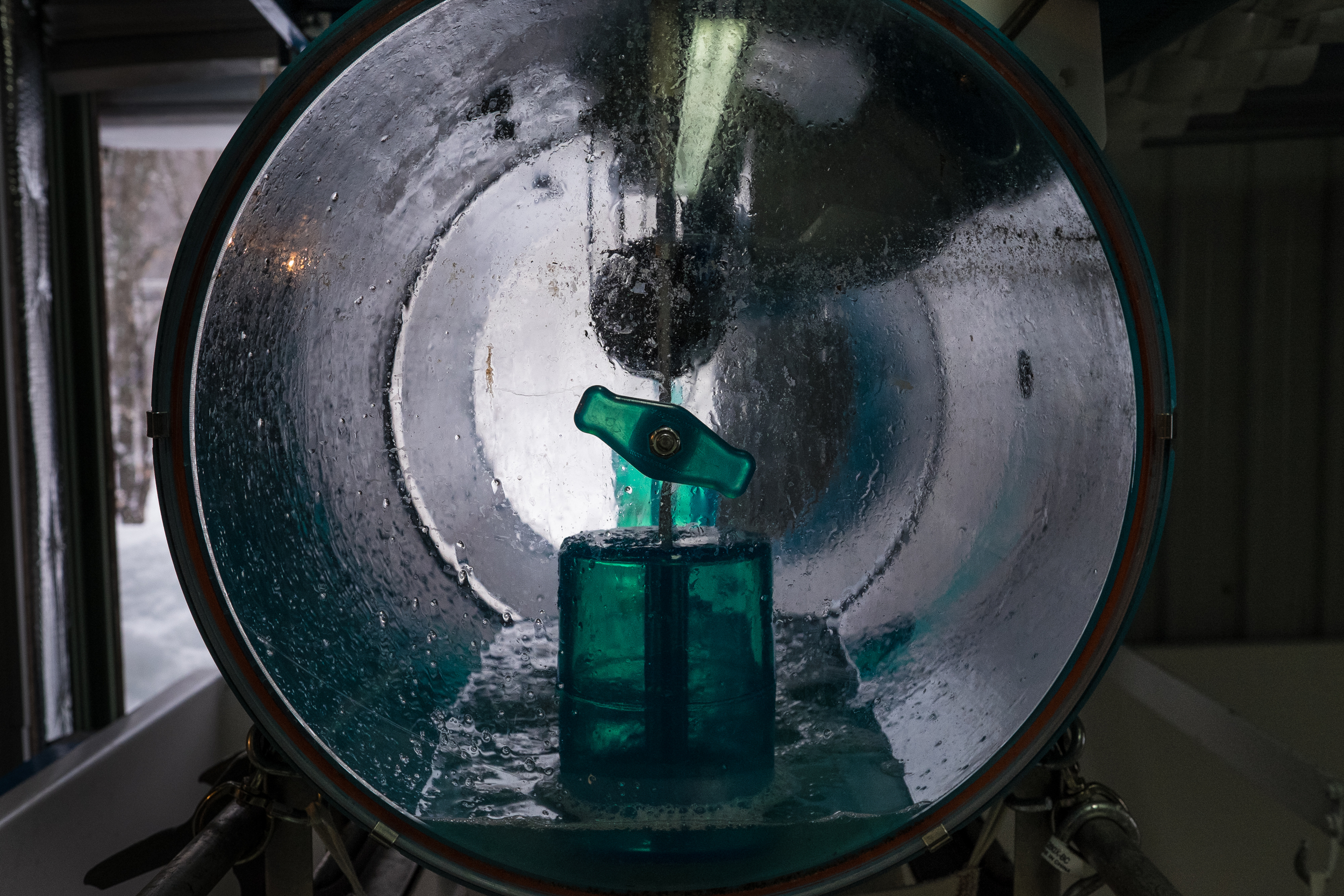

A syrup sample is tested for how much light passes through it, one of the measures of its quality. Leyland Cecco/Al Jazeera America

Maple syrup has always been a part of Quebec’s cultural heritage. Gathering at a cabane à sucre, or sugar shack, is a celebration of the harvest at the end of a long winter. Towns across the province hold annual maple festivals and pancakes, sausages and fried potatoes are served, music played and maple syrup used whenever possible. Forests are transformed by bright plastic tubing that carries the clear sap from the trees to collection barrels in small shacks.

The Quebecois history of unionism and a stubborn approach to national politics also may have played a role in the federation’s founding. But it just as easily could have been a factor known to farmers worldwide: the weather.

Producers of any agricultural product test their luck each season. Maple syrup production has a narrow window toward the end of winter, with warm days and freezing nights needed. Temperatures can be fickle, and an early spring or a late winter can cause the harvest to swing wildly.

In 1966, to combat that uncertainty, a group of producers banded together to form the Federation of Quebec Maple Syrup Producers. The federation was all but destined to be a footnote until a 1990 federal order granted it broad powers over the sale, pricing and export of syrup.

Today, the federation controls 71 percent of the world trade in maple syrup, and the spoils are worth hundreds of millions of dollars.

For years, maple syrup was seen as a secondary source of income for farmers. The costs and time needed to produce on a large scale weren’t worth the effort in the face of uncertainty. But with rapid advances in technology, many producers can now stake their entire income on the spring harvest.

The imagery sold to consumers is that of rows of buckets in a bucolic forest. But it has been left behind as the industry undergoes explosive growth. The rhythmic patter of falling sap hitting tin is now lost amongst vacuum pumps and reverse osmosis machines.

Sap pours into a collection barrel, drawn in from the trees through vacuum pumps. The sap is clear when it is first harvested. It acquires a golden brown color during the production process. Leyland Cecco/Al Jazeera America

Meanwhile, producers no longer compete against each other in Quebec, and the syndicate negotiates pricing stability. Time slowly morphed what had once been a group of concerned syrup producers into an entity that resembles a government-sanctioned cartel.

In 2002, the Federation of Quebec Maple Syrup Producers set up production quotas for its 7,300 members. Any surplus is kept as part of its Global Strategic Reserve, the name given to a pair of non-descript warehouses in Laurierville and Saint-Louis-de-Blandford, two small towns in southern Quebec with a combined population of 2,300 residents. These buildings hold more than 68 million pounds of maple syrup. Its aim is to help mitigate the risk associated with uncertain harvest seasons.

The reserve is the hub of all maple export, and rows of pristine white barrels are stacked almost to the ceiling. Most of the supply is sent to the United States, with secondary markets in Japan and Europe. One only need tour the warehouse to be reminded of Quebec’s supremacy in the syrup trade. Last year, the province produced more than 10 million gallons. The product was shipped to over 52 countries around the world. Each barrel weighs roughly 600 pounds, and commands a price of $1,650. Pound for pound, maple syrup is worth almost 20 times crude oil.

It was the surplus cemented Grenier’s opposition to the federation.

“If one year we make 45 barrels, and the next year is a very good year and we make 60, we want to get paid for the 60,” she says. Once a producer fills the quota, the surplus, no matter how large, is retained until it is sold. Barrels can sit in the warehouse for years and Grenier says her neighbor, a producer who sells through the federation, is owed almost $100,000 in unsold syrup.

Her family home is nestled in the hills near Sainte-Clotilde-de-Beauce, a municipality with a population of 600 in southeast Quebec. The area is also a flashpoint for the movement against the federation. Quebec is a fiercely socialist province, giving up only 5 of a possible 75 seats to the Conservative Party in the last federal election. Beauce, a district of farms and sprawling forest, is one of those elusive seats.

Angèle Grenier in her home near Sainte-Clotilde-de-Beauce. Leyland Cecco/Al Jazeera America

Tubes in Grenier's garage pull in maple sap. She has more than two miles of plastic tubing on her property. Leyland Cecco/Al Jazeera America

With her husband and son at the table, Grenier shuffles through piles of court documents. These are the black and white scars of her battles with the syrup giant. Her production levels are small, and don’t appear to pose much of a threat, but she is currently involved in multiple lawsuits. The family estimates they’ve spent $15,000 Canadian ($12,000) on legal fees to date. She claims the federation is also pursuing her for roughly $200,000 in fines for not complying with the rules. The lawsuit that requires her to turn over her syrup involves other producers, and collectively they owe the federation somewhere between $6 million to $8 million U.S.

The house’s attached garage is retrofitted to accommodate conduits of bright plastic tubing that carry sap in from her thousands of taps. Syrup is deep in her family lineage and she recalls four previous generations that have earned a living this way. A good year will bring the family fifty barrels, worth roughly $60,000 CAD. For years, to bypass the system, Grenier sold all of her syrup to SK Export, a New Brunswick broker and producer.

These are the sales that landed her in trouble recently. Because the law in Quebec compels a producer to sell through the federation, a court found that she had knowingly broken the law.

“I want the freedom to sell my syrup wherever I want,” says Grenier.

She is currently tied up in two cases, both at the appeals court. In one, she is arguing for her right to sell outside of the province. In the other, she’s denying the federation the right to have a monopoly on syrup in Quebec. The federation argues that because producers benefited from research into new technologies over the years, it’s only fair that they play by the rules.

Étienne St. Pierre, sitting in his office in Kedgwick, New Brunswick, argues that because he has a federal permit, he should be able to buy and sell to whomever he chooses. Leyland Cecco/ Al Jazeera America

“They’re like a mafia,” says Étienne St. Pierre, the owner of SK Export. He is notorious within the syrup community for his outspoken defiance of the federation. When the syndicate's members speak of an illicit 'black market' for syrup, they’re referring to St. Pierre. He entices producers in Quebec to abandon the consortium and instead sell directly to him. Though he offers less, his system doesn’t have the strings attached that producers in Quebec typically have to untangle. It comes as no surprise that St. Pierre is also a regular in the court system and has felt the wrath of the federation during multiple cross-provincial raids. At present, he is involved in three separate legal disputes.

These cases reflect a broad strategy to ferret out and quash rogue producers and buyers. While the tactics of the federation may seem hardheaded, they emerge from a time in which producers were once at the mercy of both the weather and buyers eager to scoop up syrup for as cheap as possible. Rather than being a ‘black market,' Grenier and St. Pierre occupy more of a grey market. While the two are breaking Quebec law, the unending legal process shows the courts aren’t quite sure how to make sense of Quebec’s monopoly and how it applies to the rest of the country.

It can be difficult to square the federation’s popular support with its pursuit of producers who refuse to comply.

“We’re young, and there’s sure to be growing pains. But the vast majority of producers support us,” says federation spokeswoman Caroline Cyr.

Of the 7,300 producers, Grenier says there are 70 who are vocally against the system.

“The federation wins most of their cases,” says Antoine Aylwin, a partner in the Montreal office of the law firm Fasken Martineau. Alywin defends purchasers within Quebec who have been accused by the federation of illegally buying syrup.

“There's a lot of instances where they won, but were unable to enforce the decision,’’ he says. “People would go bankrupt or they would hide from the federation for years. It's been very challenging for them to pursue the people not acting within the system.”

Aylwin estimates that syrup issues eat up more than a quarter of the docket of the Agricultural Marketing Board, an arbiter for disputes that precedes court involvement.

Both St. Pierre and Grenier have permits issued on behalf of the Canadian Food Inspection Agency to produce and export syrup. They argue that because a federal agency grants the permit, they should be free to sell anywhere in Canada. The federation, on the other hand, argues the law is very clear: It has the right to regulate all syrup production and export both inside the province, and between Quebec and any other markets.

In 2012, the theft of $18 million US worth of syrup from the federation’s Global Strategic Reserve became fodder for late night television and pun-laden headlines. The heist seems like a Canadian caricature, but brought to light the larger, more complex nature of an industry worth hundreds of millions of dollars. The robbery of so much syrup weakened Quebec’s position, with the federation having already emptied the stockpile a few years before. The bulk of the reserve is now kept at a new facility in the township of Laurierville. Critics of the federation allege the theft gave it a tacit mandate to crack down on producers and buyers supplying the ‘black market’ but under the guise of investigating the robbery.

St. Pierre in his warehouse. Leyland Cecco/Al Jazeera America

On Sept. 25, 2012, days after the theft at a Quebec warehouse, the federation initiated a cross border raid on St. Pierre’s warehouse in the neighboring province of New Brunswick. Everything was seized: forklifts, barrels and boilers. The authorities took almost $1.6 million US in syrup. The courts argue the seized syrup is part of an ongoing investigation, so three years later, St. Pierre still hasn’t seen it.

Sitting in his office, St. Pierre emphatically denies any link to the theft. He has maintained his innocence over the years, and argues that there are neither anomalies in his sale records nor any reason for him to buy stolen syrup. He does concede, however, that there’s no way to tell if some of the syrup he has purchased from Quebec producers could potentially be from the stolen batch, given that it was siphoned out of multiple barrels over a period of time.

“Nothing we’re doing is illegal. We have permits for everything,” says Fernand St-Amand, marketing agent at SK Exports. The two see themselves as businessmen, haggling in conference rooms with buyers over pennies to cover their margins, not the criminals the federation makes them out to be. Both are skeptical about some details of the theft.

“You’re telling me you’ve got $30 million worth of inventory and no security?” asks St-Amand, shaking his head.

Cyr says that the facility was a temporary rental, an oversight at the time, and the permanent warehouse in Laurierville is less vulnerable. The nondescript building in Laurierville is outfitted with cameras, motion activated lights, electronic key access and security guards.

Grenier’s son, Pierre-Luc, sees the theft of syrup as an excuse for the federation to focus on producers refusing to play by the rules.

“Why don’t they leave us alone? There’s 5,000 producers in the United States who are eating up the Quebec maple syrup market.”

Barrels are loaded into delivery trucks at the Federation of Quebec Maple Syrup Producers Global Strategic Reserve. Leyland Cecco/Al Jazeera America

If disgruntled producers cause an annoyance, there is a growing threat in the federation’s largest market: the United States.

In 2007 poor harvest seasons in prior years forced the federation to empty its stockpile, spiking the price of syrup. Ever since, prices have remained high, coaxing more and more people into the syrup business.

“Since 2008, production in the US has almost doubled,” says Michael Farrell, head of Cornell’s own maple syrup production facility and a researcher in maple tree ecology.

Despite the maple leaves as the insignia of the industry, the syrup business hasn’t always fallen under the control of Canadians. During the 1880s, American consumption of maple products peaked with millions of gallons. It wasn’t until the 1950s that United States maple syrup industry began its slow decline.

A group at Cornell University in New York is spearheading the reinvigoration of syrup production in America. It argues that current American output is pessimistically low and with the right investment, could relax Quebec’s current grip on the market. It is intuitive: The majority of Quebec’s exports are shipped south, so why not rebuild the infrastructure domestically?

Both Vermont and New York have tried unsuccessfully to push the Maple Tapping Access Program through Congress, which would give producers $100 million in grants over five years. New York Gov. Andrew Cuomo recently announced $1.4 million in funding for agricultural projects, including expanding maple syrup production.

The Global Strategic Reserve in Laurierville holds more than 62,800 barrels. Leyland Cecco/Al Jazeera America

The Laurierville warehouse, once used to store furniture, now stores the world's supply of maple syrup. Leyland Cecco/Al Jazeera America

Farrell envisions a future in which robust US production has returned and supplanted Quebec. If states with maple trees were to tap at the same rate as Vermont, says Farrell, then the number of taps in the country could jump from 11 million to 65 million, leading to a prospective haul of 12 million gallons per year. This would eclipse Quebec’s current rate of 10.5 million, dethroning the federation.

Farrell even sees this estimate as conservative. He and other researchers have pegged America’s total potential at more than 2 billion taps. In 2013, Canada exported 6.3 million gallons of syrup to the U.S.

Of all the states, Vermont has the largest appetite, with the average resident consuming almost 11 pounds of maple syrup per year. Thenational average is significantly less, almost registering half a pound.

Most Americans see maple syrup as a pancake topping or flavoring for desserts, despite its growing use in cooking. The high cost of the product when compared with artificial syrups made from corn syrup also hurts sales. Farrell is hoping to change this perception.

“If we just do the marketing and tell people about it, about the benefits of pure maple, and why they should spend the extra money on the real thing, we couldn't possibly tap enough trees to supply that market," says Farrell.

Up in New Brunswick, St. Pierre is excited about the prospect of a growing American market, not only because it means a larger base for his brokerage, but also because of its ability to encroach on the federation’s territory.

This question has hovered over the industry for the last few years and only becomes more pressing as both the federation and the US producers enter a game of commodities brinkmanship.

“If you think the pie is only so big, and you can only sell so much maple syrup, and more of it’s coming from the US, then that would be considered a threat to the federation,” says Farrell. “But I think expanding markets helps everyone.”

Maple treats and souvenirs are displayed in a window in Quebec City's Old Quarter. Leyland Cecco/Al Jazeera America

Sugar shack operator Simone Vezina is reflected in a new batch of maple syrup. Leyland Cecco

With Quebec’s massive stockpile continuously growing, flooding the market or just lowering prices could remove the incentive for Americans to keep producing. Cyr dismissed the idea, saying “When we make decisions, we do them for our producers, not anyone else.”

“I think the federation is worried,” says Brian Chabot, professor emeritus at Cornell and co-author on the research paper about America’s potential syrup markets. “But I don't think it's going to happen fast enough to be an immediate threat to them. I'm pretty sure they're developing their strategies.”

Cyr says the next markets of interest to Quebec are the United Kingdom and India.

Quebec’s production is still more than triple the entire American output. And the federation controls 90.4 percent of Canada’s production, making the remaining provinces little more than an afterthought.

“We have the potential for 100 million taps,” Cyr says.

That expanded capacity, attainable with the infrastructure already in place, would almost double Farrell’s projected American increase. Any attempt to unseat Quebec requires cooperation between states to develop a network rivaling its competition over the border.

Despite all of the planning, the impact of climate change could derail American ambition.

The exact impact it will have on swaths of maple trees remains uncertain. Over the last few years, grim reports in the media have predicted the decline of the maple syrup industry. A ‘tree atlas’ developed using U.S. Forest Service models suggests harvest and production could shift northward.

In traditional areas of syrup production like Vermont and New York, very little could change. But states farther south, such as Connecticut and Ohio, could see a restricted supply over the years.

Professor Brian Chabot of Cornell is less sure about these predictions.

“A northward push isn’t so obvious now,” he says. “The main effect has been pushing the season closer to Christmas. That's the main effect we predict modeling a warming climate.”

He and Farrell argue that there may even be a growth in these southern areas. For example, both Kentucky and Indiana, which have little maple syrup presence, have the potential for a combined total of 3.5 million taps, if they were to tap maple trees at a rate similar to Vermont.

Despite the overall warming trend, this winter has been particularly cold in the northeast, pushing back the start of the season in Quebec by more than a month. It is a reminder that producers are at the whim of seasonal unpredictability.

With no stockpile, a string of bad winters would be a setback for American producers. Over the years, Quebec learned the hard way how quickly weather can ruin a harvest. The federation’s reserve allows its producers to endure multiple poor seasons and emerge unscathed.

At the Grenier house, the family is unsure how much longer they can weather the storm against the federation.

“We would have less trouble if we were growing pot,” Pierre-Luc says. “The agent who came here to seize our syrup said, ‘If you were growing pot, we wouldn’t be giving you as much trouble.’

“But maple syrup is a greater threat.”